6 Questions PNG Expats Need to Answer Before Signing Employment Contracts

So you’ve landed your dream job as an expat in Papua New Guinea and you’re getting ready to start the next chapter of your life.

In our experience at Peopleconnexion, when you’re caught up in the rush of paperwork, visas and phone calls, key issues like tax, superannuation and investments can be the last thing on your mind.

Whether you’re being placed in a residential position or a FIFO roster, the reality is that you are going to need to learn how to manage your finances in a different country without leaving yourself high and dry when you return home.

For some clarity on this topic, we asked Daniel Billings at Tenfold Wealth to weigh in on the financial factors you need to consider as an expat. Daniel has had experienced both sides of the coin, having worked as an expat in PNG and advising professionals on how to manage their wealth.

“The length of time one is away from Australia is an important consideration, the tax treatments for short-term contracts vs longer-term employment are very different. Likewise, if an individual is an employee or has the ability to become a contractor.

These factors should generally be considered at the recruitment stage and a full understanding of the after-tax benefit should be known before accepting a contract.”

- If you’re considering a role in Papua New Guinea, browse our current jobs or get in contact with us.

- If you’re looking to set up business in Papua New Guinea, contact us about our high-quality recruitment and payroll management services and find out how we can support you.

1. What are the taxes like?

Our candidates are always surprised that PNG’s taxes are so high.

For many expats, the 42% tax rate for salaries over 250,000 PGK ($106,726 AUD or $78,281 USD) is even higher than the tax they would pay at home.

For example, if you have a salary of $140,000 AUD (328,947 PGK), you will pay about $58,800 AUD (138,157 PGK) in tax (assuming no deductibles or other taxable items).

On the same income (assuming no other factors come into play), you would pay roughly $39,750 AUD in Australia, $37,690 AUD in New Zealand and $43,850 AUD in the Philippines (as at time of writing in 2017).

2. Can you make this work for you?

Short answer: yes.

The long answer however, is a little more complicated. If your home country allows you to claim foreign tax credits, you could hypothetically offset the extra tax you have paid in PNG (within tax guidelines).

For Australians, this works on a case-by-case basis. The maximum amount you can offset is capped by an individual limit that applies each year. Put simply, this limit is the comparison between your tax liability and your liability if foreign income and related deductions were disregarded.

You can offset your returns up to this limit, however it doesn’t carry over between years.

At the time of writing, Papua New Guinea’s tax system also allows tax credits to be claimed from foreign taxes paid including interest, dividends or rental income.

For anyone operating across borders, this could be a huge selling point if you are claiming dividends, rental income or incurring expenses that will push up that offset limit.

3. What is exempt?

If you are treated as a Papua New Guinea resident for tax purposes and your employer directly pays your children’s primary and secondary education fees, this amount is exempt from tax. If you will be responsible for directly paying for their education, the situation is a little different.

You are also exempt from paying tax on one annual leave fare for you and your family, and recreational fares and accommodation in PNG (assuming they do not exceed the value of your one annual leave fare). If your employer provides these benefits for you as cash allowances, they will not be exempt.

4. My package is pretty comprehensive, what does this mean for tax?

According to KPMG, all types of compensation and other benefits can be considered taxable income regardless of where they were paid. At the time of writing, this includes:

- Cost-of-living allowances

Round sum expense allowances- Share option exercises

- Reimbursements of foreign and home country taxes

- Benefit of loans at zero interest or reduced rates provided by your employer

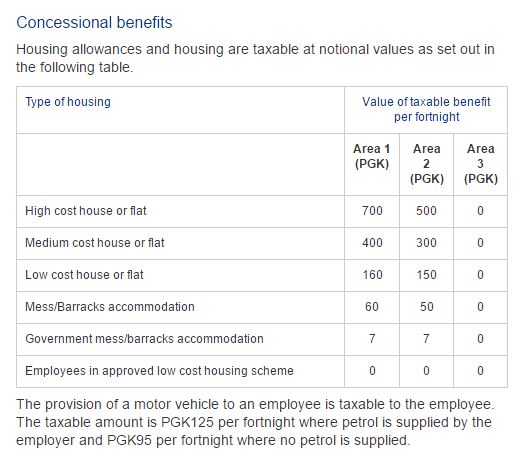

Accommodation, motor vehicles and meals provided to you may be subject to concessional taxes:

Source: KPMG, accurate at time of writing

5. What about superannuation?

Superannuation is always a consideration, if employed overseas its likely you will miss out on contributing to super back in Australia. One of the most important elements for building wealth is regular investment.

By not earning an income in Australia and not having regular super contributions you could miss out.

Understanding your cash flow obligations and looking to invest the surplus in the most tax-effective way is an important consideration when we work with clients?

In Papua New Guinea, mandatory employer superannuation contributions sit at 8.4% for residents after three months of employment, however no requirement exists for expats. You can however, make voluntary superannuation contributions back in your home country or to a fund in PNG. PwC outlines how contributions are taxed on their website.

For Australians, the superannuation contribution cap is changing as of 1 July, 2017 to $25,000 which is taxed at a marginal tax rate plus an excess concessional contributions charge.

6. How are you going to manage everything?

There’s no doubt about it – navigating issues like tax credits, deductibles, superannuation, tuition and investments across borders can be complicated. To write this article, we must have had about 30 tabs open full of complex rule changes and conflicting advice.

The best course of action is to consult a professional who understands your situation – and Daniel agrees.

“Finding an adviser who will work with you across borders is always tricky. We are all generally limited in where and how we can provide advice. However it’s important and something we stress to clients to ensure you see us before you go!

It makes life much easier if we are able to get particular structures in place while still in Australia. These days technology makes life easier and we often video chat or web conference with many clients.

The most important piece of advice is to surround yourself with trusted advisors. Expat life not only is an amazing opportunity for adventure but becoming an expat generally also comes with financial benefits. You should have a plan in place to understand your existing financial commitments in your home country whether it be property, investment, kids schooling etc. and figure out the most effective way to earn an income as an expat.”

Contact Us

Whether you’re on the lookout for roles in Papua New Guinea, or a trusted recruitment and payroll management provider to support your expatriate and contractor recruitment needs, please contact us for a confidential conversation.

Please leave your full name, number, email and query in the form below.

Disclaimer: The opinions expressed in this article are our own and are not intended to replace professional financial advice.