As Australia emerges out of lock-down hibernation, workers are well placed in an advantageous seat to fill the supply gaps of labour in the workforce. Further, as the Australian Government finalises its plans to reopen Australia’s international borders, Australia’s migration programme is set to resume and address the skills shortages the nation has incurred.

Interestingly however, The Australian Financial Review reported this month that ‘Employers can’t rely on the reopening of borders to solve skill shortages’.

Speaking as an expatriate from the UK, Australian Constructors Association (ACA) Chief Executive Jon Davies, said workers would be reluctant to travel to Australia from the northern hemisphere because of concerns about becoming marooned by pandemic restrictions and becoming stuck, in the term coined ‘Fortress Australia’.

So, shortage wars aside, what does our market look like? What projects are on the horizon and where are the skills needed?

Infrastructure labour demand will soon reach unprecedented levels: by 2023, shortages will be three times greater than in 2017-18, and it isn’t forecasted to pass until 2028. The infrastructure market is drawn from four infrastructure-based occupational groups: project management professionals; engineers, scientists and architects; structures and civil trades and labour; and finishing trades and labour. Of these occupations, it is reported that 68% are in shortage or are likely to be, especially in regional Australia.

Our recruiters are witnessing this shortage first-hand as across the market, agencies are competing for specialised engineers who hold not only the skills but the bargaining power for the work that interests them the most.

Our Divisional Manager for Engineering & Construction, Richard Christer said, “I believe if companies want to ensure they have the capacity to get the work out the door, they need to ensure their talent acquisition and talent management structures are geared toward innovative solutions”.

According to the Queensland Major Contractors Association’s Major Projects Pipeline Report (QMPPR), this is a snapshot of Queensland’s current Infrastructure market:

- Major project activity has risen 41% in 2021/22, surpassing $10b for the first time since 2013/14.

- Given the concentration of Qld’s population in SEQ, around 45% ($15.9b) of all funded work in the pipeline is focused there. Brisbane itself has the highest levels of work ($6.8b)

- The Ipswich–Toowoomba–Logan corridor has the strongest growth in funded work over the next three years, while the Townsville, Cairns, Fitzroy, Wide Bay and Outback regions all have very strong growth potential.

- The five-year projected pipeline is $11.3b larger than in April 2020, with $8b of the increase coming from funded projects.

- Brisbane and the broader SEQ region remain critical for funded major project activity

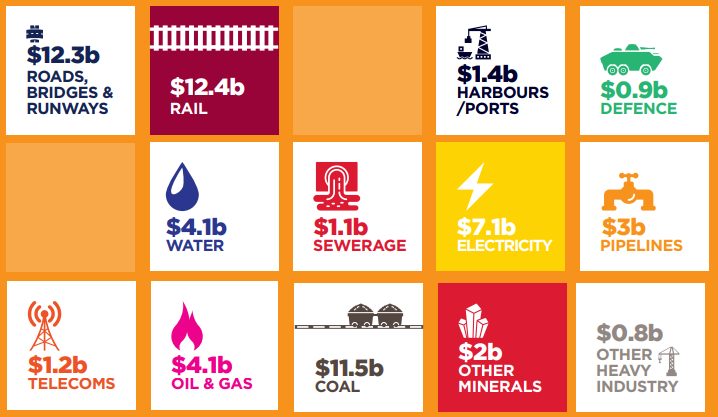

Brisbane’s success in winning the right to host the 2032 Olympic and Paralympic Games presents a once-in-a-generation opportunity to accelerate economic infrastructure development over the second half of this decade to meet Queensland’s longer-term infrastructure needs. A snapshot of the value of pipeline projects by sector from 2021/22 to 2025/26 is below:

Image credit: Queensland Major Projects Pipeline 2021

The report highlights the realm of specialist skills which will become available for these pipeline projects and Access to labour is one of the key areas of concern identified in the report.

In the report, QMCA CEO Andrew Chapman stated, “Queensland’s pipeline is strong, but there are challenges that could impact on the state’s ability to deliver projects. We are competing with the southern states for resources, both New South Wales and Victoria [who too], have significant project pipelines.”

Richard shares his thoughts by saying, “With such substantial investment and forecast spend in project delivery, it makes sense that companies start looking at resources from abroad. If these projects are to be delivered in the short term there is little, or no other option but to sponsor professionals from abroad. Ultimately Australia needs more engineers than we have, or are producing”.

However, it isn’t all just focused on SEQ. In September, the Deputy Premier and Minister for State Development, Infrastructure, Local Government and Planning released a statement that the Palaszczuk Government is delivering a four-year $52.2 billion infrastructure pipeline, including 81 projects in Far North Queensland which is expected to directly support around 46,500 jobs – nearly 30,000 of these in regional Queensland. These projects will also support long-term jobs in kay industries including health, innovation education and high-end manufacturing.

With the concern of access to labour, how will Queensland, and more broadly, Australia, successfully commence and complete the major works in the pipeline? We wait in anticipation for the Australian Government to open international borders and have skills bought in from abroad to be a fix, weather it be a short-or long-term economic recovery fix.